salt tax deduction changes

Web Accordingly the taxpayers 2018 SALT deduction would still have been 10000 even if it had been figured based on the actual 6250 state and local income. Web The 10000 cap imposed in 2017 as part of the Trump tax cuts will sunset in 2025.

Surveyed Tax Pros Pessimistic On Changes Grant Thornton

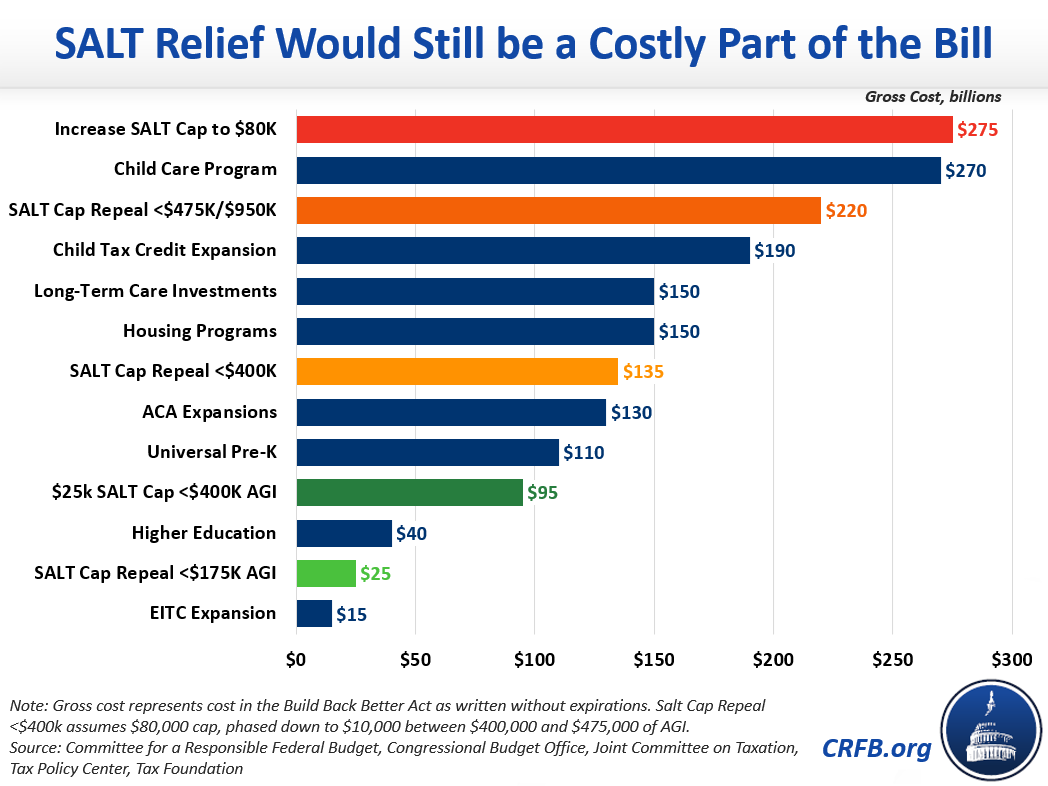

The House-passed Build Back Better Act for example would.

. Web But you must itemize in order to deduct state and local taxes on your federal income tax return. Web New limits for SALT tax write off Starting in 2021 through 2030 the SALT deduction limit is increased to 80000. The Tax Cuts and.

Web Cap on SALT Tax Deductions Before the Tax Cuts and Jobs Act of 2017 there was no cap on the amount that could be deducted on a federal tax return. Web Senate Democrats say a proposal to raise the cap on state and local tax SALT deductions a top priority of Senate Majority Leader Charles Schumer D-NY. During negotiations in the Senate on the 737 billion spending bill Republicans.

Web House Democrats spending package raises the SALT deduction limit to 80000 through 2030. Web The nonpartisan Tax Policy Center found that if the SALT cap were to be repealed entirely 70 percent of the benefits would go to people with annual incomes. Web Lawmakers are currently considering possible changes to the state and local tax SALT deduction.

In an unsurprising near party-line vote the. Web As Congress wrestles over changes to the 10000 cap on the federal deduction for state and local taxes known as SALT many business owners already. Web The state and local tax SALT deduction permits taxpayers who itemize when filing federal taxes to deduct certain taxes paid to state and local governments.

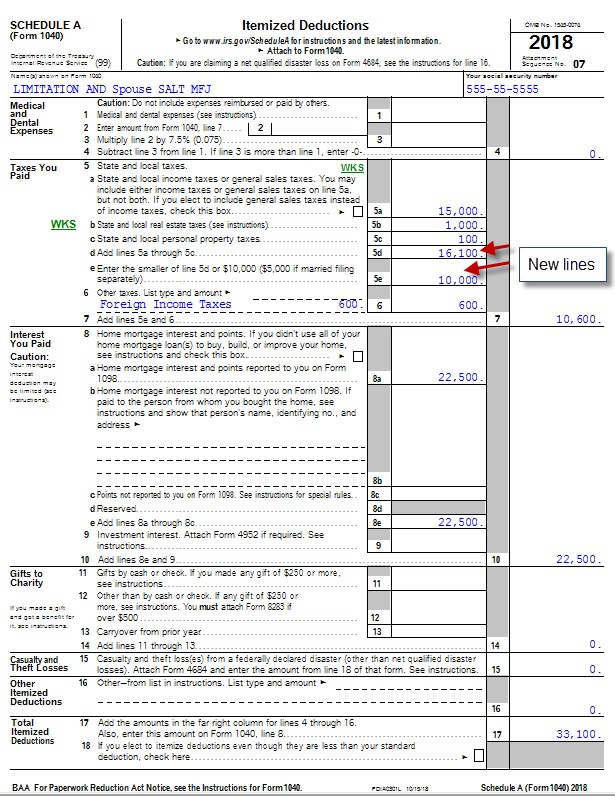

Web 52 rows The SALT deduction is only available if you itemize your deductions using Schedule A. Web A 10000 ceiling on the previously unlimited SALT deductions was enacted and made applicable for taxpayers between 2018 and 2025. Web While the Tax Cuts and Jobs Act placed a 10000 cap on the SALT deduction its only temporary.

For your 2021 taxes which youll file in 2022 you can. Web In the most basic terms the proposed changes to the SALT deduction would increase the deduction cap from 10000 to 72500 per year with the raised cap. Second the 2017 law capped the SALT deduction at 10000.

Web House Democrats on Friday passed their 175 trillion spending package with an increase for the limit on the federal deduction for state and local taxes known as. The cap applies to taxable years 2018 through 2025. Web Republicans 2017 tax cut law created a 10000 cap on the SALT deduction in an effort to raise revenue to help pay for tax cuts elsewhere in the measure.

Web Republicans passed the 10000 SALT deduction cap as part of their 2017 tax law as a way to help offset the cost of tax cuts elsewhere in the bill. Ways Means approves a temporary repeal of the SALT deduction cap. This significantly increases the boundary that put a cap on the.

Web Reduced SALT and State Tax Changes. The change may be significant for filers who itemize deductions.

Repealing The Salt Cap Should Not Be A Top Priority In Reforming 2017 Tax Law Center For American Progress

Repeal Of The State And Local Tax Deduction Full Report Tax Policy Center

5 Year Salt Cap Repeal Would Be Costliest Part Of Build Back Better Committee For A Responsible Federal Budget

Mortgage Interest Deduction Reviewing How Tcja Impacted Deductions

Voters Increasingly Oppose Proposed Salt Deduction Changes

How Tax Reform Affects The State And Local Tax Salt Deduction Tax Pro Center Intuit

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551645/percent_households_SALT_elimination_tax_hike.png)

The State And Local Tax Deduction Explained Vox

How To Deduct State And Local Taxes Above Salt Cap

Local House Members Including Republicans Pushing To Change Key Part Of Trump Tax Law Orange County Register

The Salt Cap Overview And Analysis Everycrsreport Com

Coping With The Salt Tax Deduction Cap

Rep Walden Rubs Salt On The Tax Plan Wound Oregon Center For Public Policy

How Did The Tcja Change The Standard Deduction And Itemized Deductions Tax Policy Center

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

The State And Local Tax Deduction Explained Vox

For Most New York Income Tax Filers Salt Deduction Still Isn T Missed Empire Center For Public Policy

Ira Senate Climate Health Bill Keeps Salt Cap Over Dem Objections

How Does The Deduction For State And Local Taxes Work Tax Policy Center

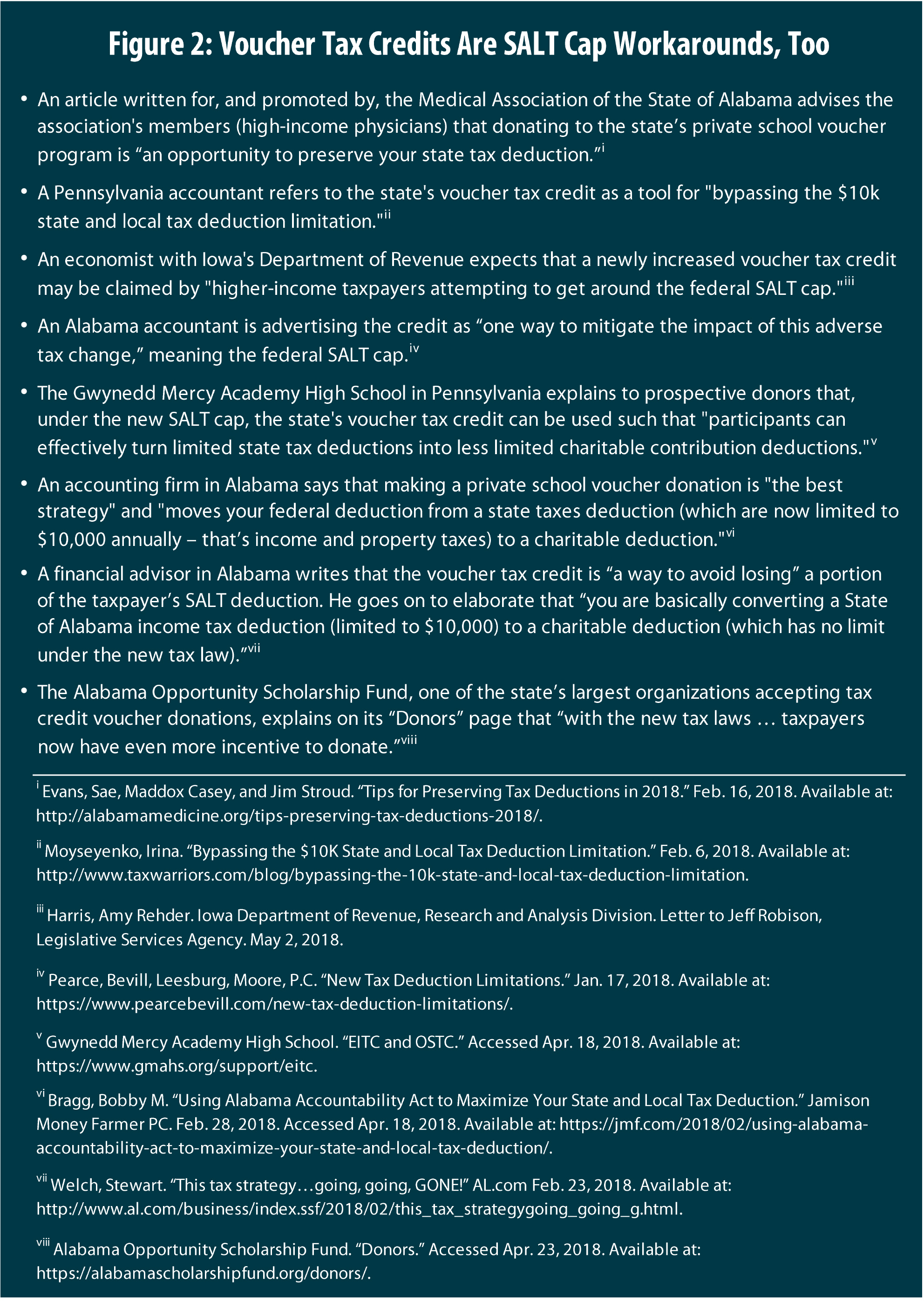

Salt Charitable Workaround Credits Require A Broad Fix Not A Narrow One Itep

New Salt Proposals Would Improve House Bill Committee For A Responsible Federal Budget